Dealing with accidents can be difficult if you’re not aware of the right insurance claims to file for. Everything has a time limit in such matters. If you exceed filing deadlines, you may not get to seek compensation.

One of the key claims to know about is a diminished value claim in Florida. Fortunately, you don’t have to search any further about it. Below we have detailed everything about how to file a diminished value claim.

What Is Diminished Value?

A car’s value is indicated by many things such as its:

- Mileage

- Condition

- Whether it has been in accidents before or not

If you experience a car crash in Florida, it will decrease your car’s value automatically.

For example, your vehicle may be selling at a rate of $20,000 before the accident. However, the crash decreased its value to $10,000

This is called diminished value. You can file a claim to seek the value difference from the at-fault party and restore the car to its original value.

Typically, you’ll have to file this claim with the at-fault party’s insurance company.

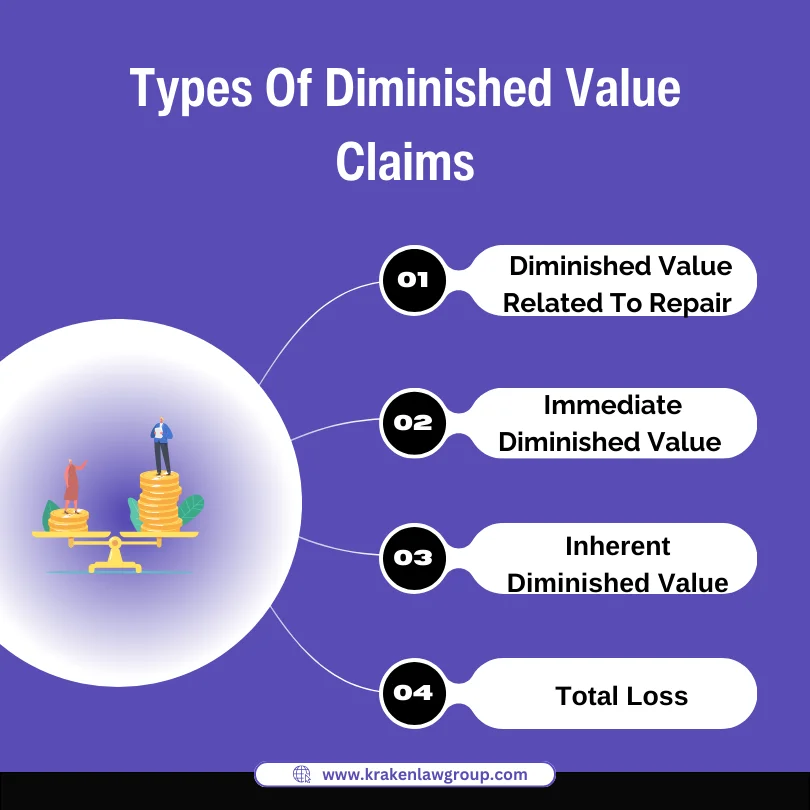

Types Of Diminished Value Claims

A diminished value claim in Florida can be applied to accidents in different ways. Let’s look at the types of these cases:

1. Diminished Value Related To Repair

A diminished value claim in Florida related to repair is applicable when you want to fix your car after a crash. Repairing the car will fix its external and internal problems, but that doesn’t mean the vehicle remains new.

This is why buyers perceive the car to be worth less than its value before the crash. The best way to ensure the value doesn’t diminish significantly is by fixing it using original parts.

These are usually expensive and offered by car dealerships. That is why you can file a repair-related claim to seek compensation for such original repairs.

Remember if you repair the car using knock-off parts from local mechanics, the value of your vehicle will decrease further.

2. Immediate Diminished Value

An immediate diminished value claim Florida considers the resale value of the vehicle after an accident and before any repairs are done. This difference is the original reduction in a car’s value after crashes.

That is because it involves an immediate decrease in a vehicle’s selling value. You can recover the difference by filing this claim with the at-fault party’s insurance.

Most people use the compensation from these claims to repair their cars with utmost perfection. Fixing the car may increase its selling value slightly.

3. Inherent Diminished Value

The most famous form of diminished value is an inherent claim. It is the amount of a car that has been in an accident and repaired.

The primary purpose of these claims is to ensure your car returns to the best working quality after the accident.

When high-quality repairs are not achieved, increasing the value of the car can be highly difficult. Another key feature of this type is that it forms the basis of supplemental values.

Sometimes a supplemental value may be added to an inherent claim to recover your losses accurately.

4. Total Loss

Every car doesn’t experience the same type of damage after accidents. Some may receive minor scratches, while others may go beyond the extent of repair.

The latter can be an example of total loss. A car comes in this category when its value reduces more than 70% of the market rate. This means the repair costs will be near the car’s pre-accident value.

For instance, you may have bought a vehicle for $15,000. The accident may cause you to suffer from damages worth $13,000. In such cases, your car will be a total loss.

Another case of total loss is when the car becomes unsafe to drive. The insurance company may pay the repair costs, but the vehicle may still pose safety risks.

Hiring a car accident lawyer can help you file for this diminished value claim in Florida easily.

Grounds For A Valid Diminished Value Claim In Florida

Before filing claims with insurance companies, you must ensure you meet the filing grounds. Otherwise, your request will be rejected.

The typical grounds for a diminished value claim in Florida include:

- The other driver must be at fault for the crash

- The car must suffer significant damage to reduce its value

- You’re unable to return the vehicle to its original value and have proof of it

If you meet these claim grounds, you can file a case and recover your losses easily. Consulting a car accident attorney may help you understand if your case is valid or not.

How To File A Diminished Value Claim In Florida

Learning how to file a diminished value claim in Florida is necessary to recover your losses after car crashes. Follow the steps below to do that:

1. Gather Evidence Before Filing a Diminished Value Claim in Florida

The top thing you must ensure to start a diminished value claim in Florida is proving you’re not the at-fault party. You may file a police complaint so they can conduct a proper investigation.

Meeting with accident witnesses may also help you prove the other driver was at fault. You’ll also have to collect different documents before you can start a claim.

For example, you must ensure the value of your car has reduced significantly. You’ll require the invoices of the repair shop to prove this. It’ll also be necessary to get an appraisal of your car’s value and expert testimony to prove it.

Be sure to take pictures of your car damages after an accident to ensure the insurance company doesn’t reject your claim. Many agencies may refuse a payout by claiming specific damages were present before the accident.

This is why it is necessary to collect evidence thoroughly before you inform the insurance provider of the at-fault party.

Submitting solid documents will prevent the company from rejecting your diminished value claim in Florida unnecessarily.

2. File A Claim Within The Right Time Limits

Knowing the time limits for filing a diminished value claim in Florida is significantly important. Waiting too long may prevent you from losing compensation and recovering your losses.

The first thing you must find out is the statute of limitations for a diminished value claim in your state. Every state has different laws, so the time limits apply differently.

You must also ask the at-fault party’s insurance agency about their filing deadlines. The company may have a policy that can affect your statute of limitations. Such a thing is unlikely, but an agent may misinform you to avoid a payout.

Remember an insurance company’s main aim is not to help but to minimize their financial losses. So they can engage in various bad-faith tactics to avoid paying you.

3. Meet An Attorney

The final thing you must do to file a diminished value claim in Florida is meet an attorney. A car accident lawyer can help you understand how an insurance agency conducts its investigation.

They may also prepare you for an interview the agency may conduct. The at-fault party’s provider may want to meet you to gather details in person.

It is necessary to be careful in such interviews because the company may use your words against you. This is the most common tactic an insurance provider uses to deny claims.

Hiring a lawyer may also be fruitful if the case goes to court. The insurance agency may refuse to cover your losses completely. Sometimes they may provide a lowball offer or categorize your claim type incorrectly.

An expert attorney will tackle all these tactics for you to recover your losses accurately. They may also guide you on what to do if the at-fault party doesn’t have auto insurance.

How Long Do You Have To File A Diminished Value Claim In Florida?

The statute of limitations for a diminished value claim in Florida is four years. This time starts from the day of the crash. If you don’t file a claim within this range, you cannot start a case afterward.

This is why you must not wait too long after an accident. Get an appraisal of your car’s value promptly. File a police complaint immediately to gather evidence.

Some people repair their cars themselves and later realize the diminished value when they try to sell them. By then it may be too late to initiate a claim and recover your value difference.

FAQs

How Do You Calculate Diminished Value Claim In Florida?

There is no specific formula for calculating this value. You can make an estimate by getting your car’s resale amount appraised by an expert.

Comparing that value with the vehicle’s retail price may help you find the difference.

What Is Diminished Value In Orlando?

Diminished value in Orlando refers to the reduction of a vehicle’s value after an accident. Your vehicle may be a car, truck, bike, or more.

What Is Diminished Worth?

A diminished worth is the decreased value of a car after an accident. It considers physical damages and loss of quality.

What Is Loss Of Use Damages In Florida?

The loss of use damages allow a vehicle owner to recover its damages. For example, your car may be being repaired at the dealership shop after an accident.

During that time, you cannot use the vehicle and will be suffering from loss of use for which you can seek compensation.

Get The Right Legal Help With Our Personal Injury Lawyer In Orlando

Now you’re completely familiar with filing a diminished value claim in Florida. If you need an attorney, phone us today to meet with our expert team of car accident lawyers. They will offer you the best advice in filing a claim and recovering your losses.